green card exit tax calculator

The mark-to-market tax does not apply to the following. And if you trip any of these tests you should calculate the exit tax.

Texas Instruments Ti 30x Iis Scientific Calculator Blue Walmart Com

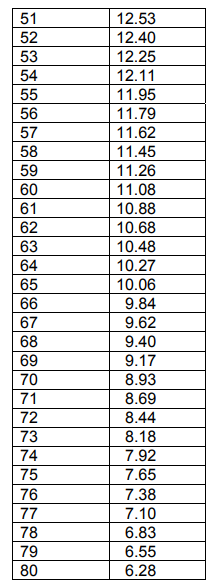

For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

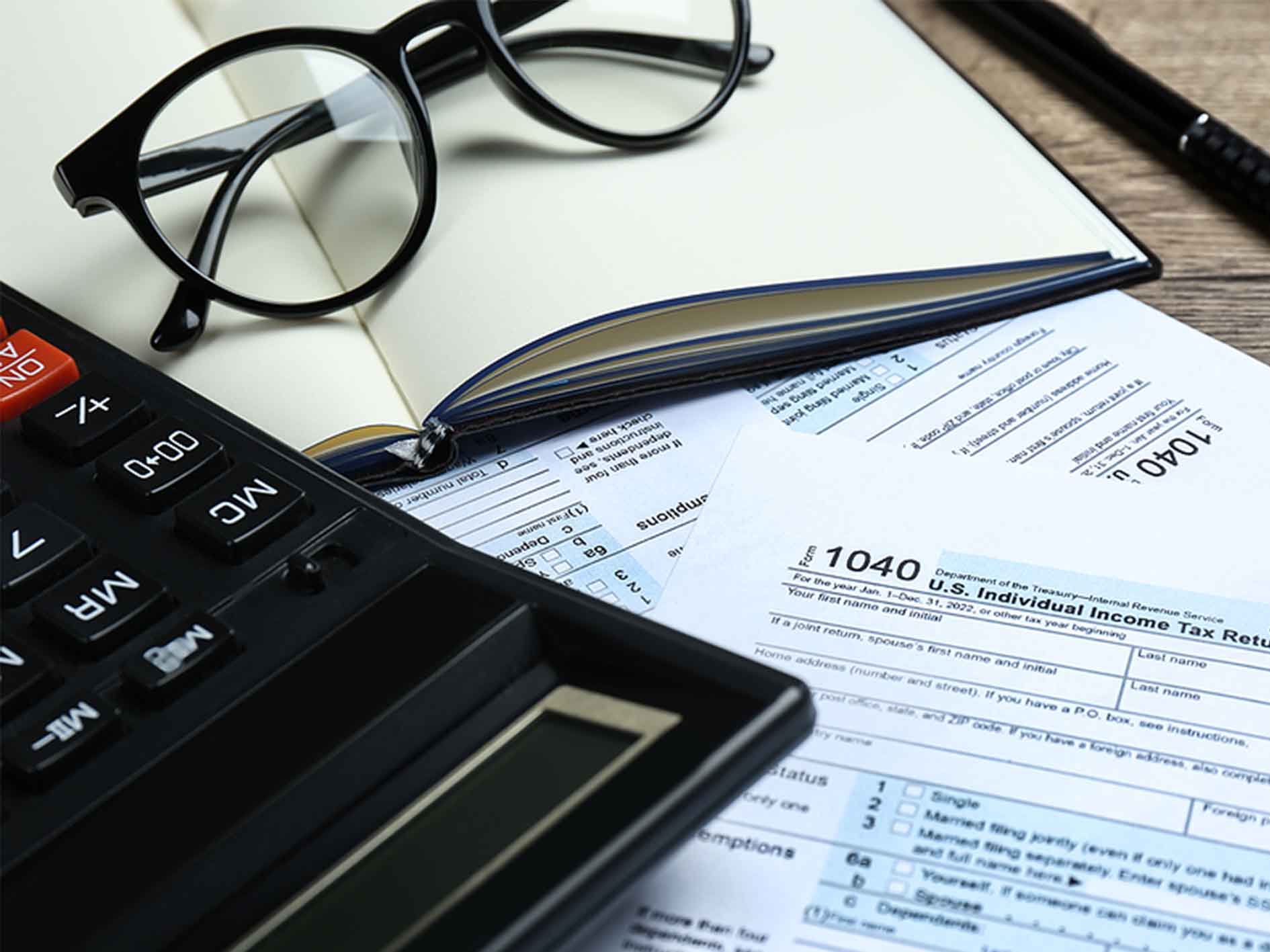

. Exit tax is calculated using the form 8854 which is the expatriation. Green Card holders who have lived lawfully in the US for eight out of the last fifteen years may be subject to the exit tax regardless of their income net worth or filing compliance. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return.

Citizens who have renounced their. AFTER becoming a US. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

Permanent residents and green card holders are also required to pay taxes. Citizen or Green Card holder ARE. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used.

For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable. Our USImmigration Calculator provides you with various categories of immigration data and statistics. In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US.

Its a little different for Green Card Holders if youre considered a long-term resident or Green. Exit tax applies to. How the Exit Tax is calculated in general what is subject to the Exit Tax.

Pensions earned OUTSIDE the US. For married taxpayers each spouses net worth is calculated separately from the other. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

The Form 8854 is required for US citizens as part of the filings to end. Green Card Exit Tax Calculator. Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854.

We have several calculators and tools so you can get the latest updates and. Green card exit tax rate. It is not just your US.

This is the aggregate net value of worldwide assets. Green Card Exit Tax Abandonment After 8 Years. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or.

Government revokes their green card visa. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

Ad Our Resources Can Help You Decide Between Taxable Vs. An estimated 800000 immigrants who are working legally in the United States are waiting for a green card an unprecedented backlog in employment-based immigration that has fueled a.

The Taxes That Raise Your International Airfare Valuepenguin

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

Home Office Deduction Calculator 2021

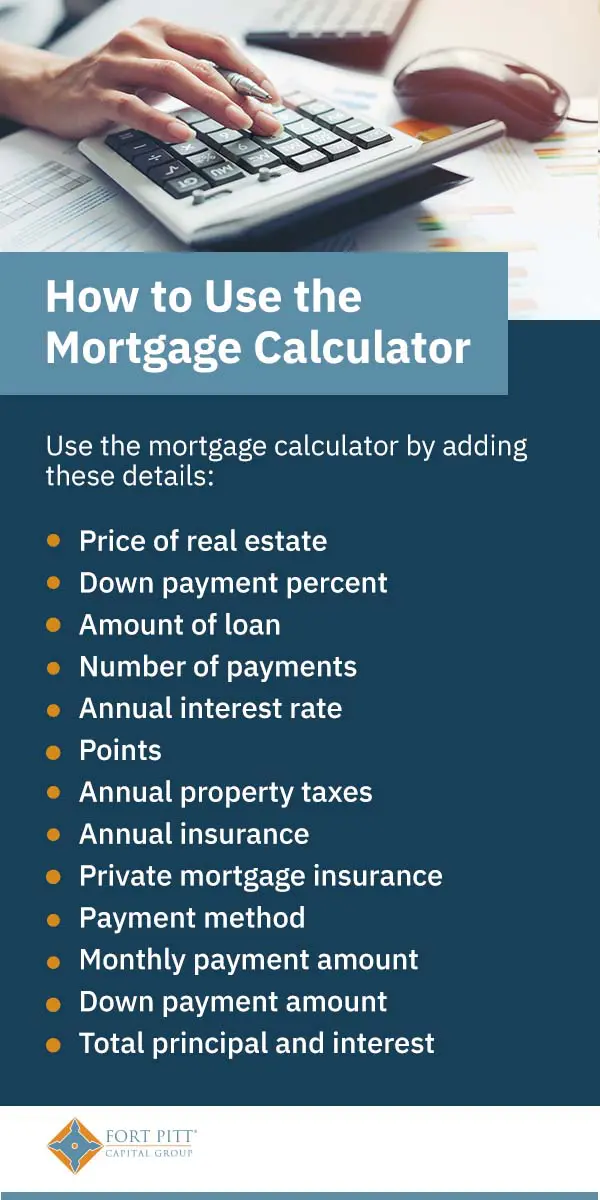

Mortgage Calculator Estimate Your Monthly Payments

Once You Renounce Your Us Citizenship You Can Never Go Back

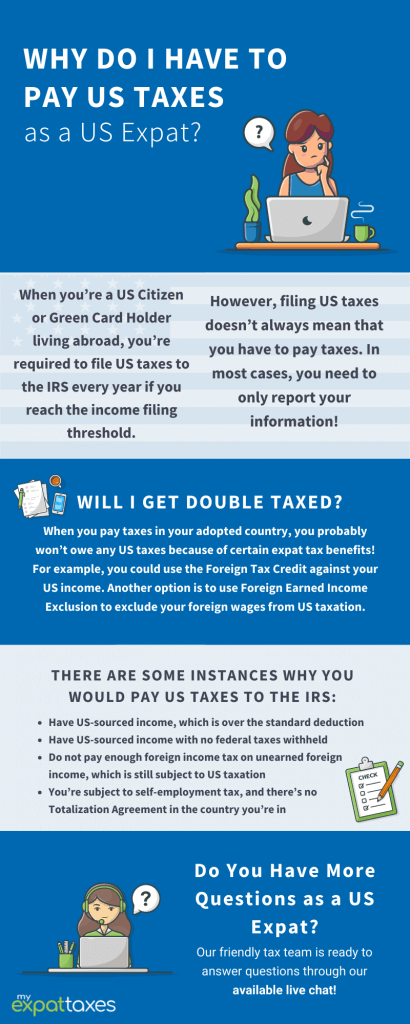

Paying Us Expat Taxes As An American Abroad Myexpattaxes

What Is Form 8854 The Initial And Annual Expatriation Statement

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

Exit Tax How To Plan Expatriating From The U S New 2022

Paying Us Expat Taxes As An American Abroad Myexpattaxes

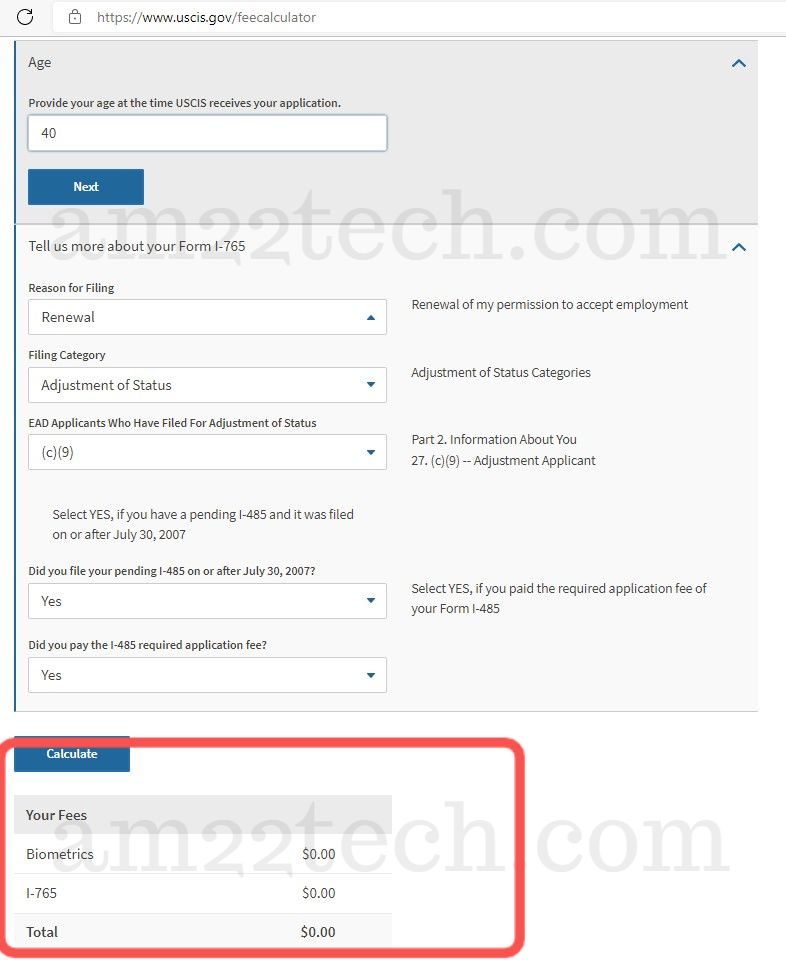

How To Renew Green Card Ead I765 While I485 Is Pending Usa

Ti 30xiis Scientific Calculator Blue Free Shipping

Part 1 Facts Are Stubborn Things The Possible Effect Of The Us Exit Tax On Canadian Residents U S Citizens And Green Card Holders Residing In Canada And Abroad

Tax Resident Status And 3 Things To Know Before Moving To Us